Bitcoin halving is a critical event in the cryptocurrency world that occurs approximately every four years. It significantly impacts the rate at which new Bitcoins are introduced into circulation, contributing to the digital currency’s scarcity and influencing market dynamics. For crypto investors and enthusiasts, understanding the intricacies of Bitcoin halving is essential for making informed decisions.

What is Bitcoin Halving?

Bitcoin halving is an event coded into the Bitcoin protocol by its creator, Satoshi Nakamoto. On halving day, the reward given to miners for validating transactions and adding them to the blockchain is cut in half. This reduction occurs roughly every four years, or after every 210,000 blocks.

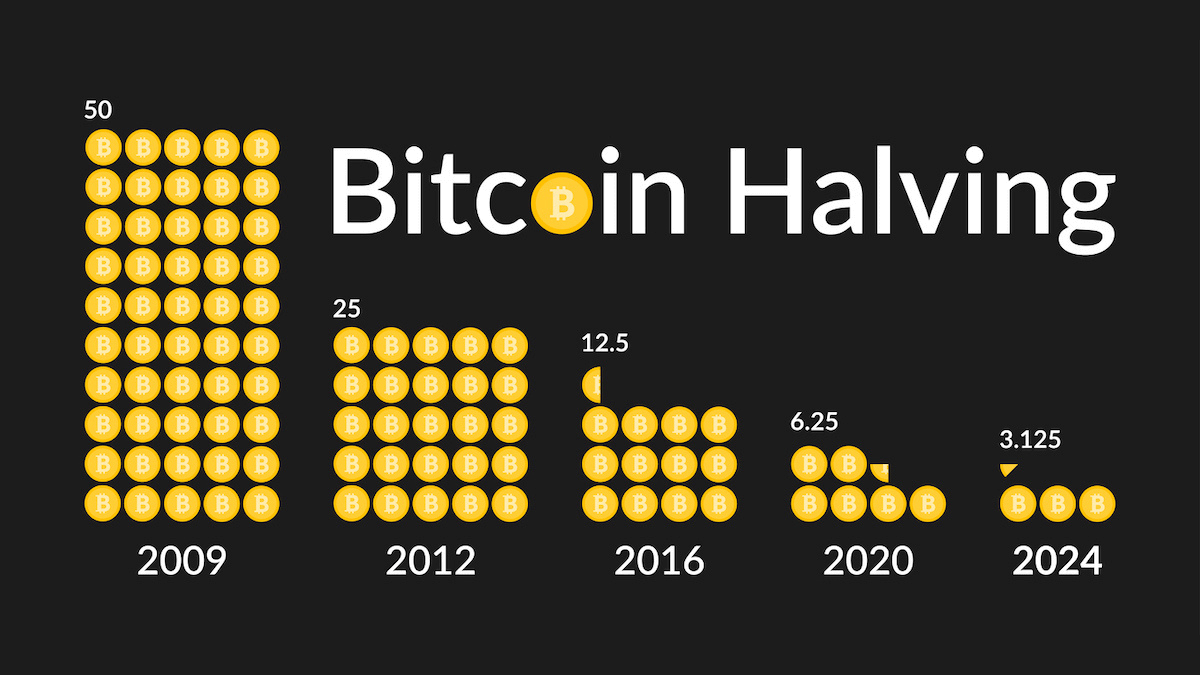

For instance, at the start of 2020, miners received 12.5 new Bitcoins approximately every 10 minutes. In May 2020, this reward was halved to 6.25 Bitcoins. The next halving, went through back in April of 2024, will reduce the reward further to around 3.125 Bitcoins. This process will continue until the maximum supply of 21 million Bitcoins has been mined, which is estimated to occur around the year 2140.

The Importance of Bitcoin Halving

Bitcoin halving plays a pivotal role in the cryptocurrency ecosystem for several reasons:

- Increased Scarcity: With each halving, the number of new Bitcoins entering the market decreases, making the digital currency more scarce. This scarcity can enhance the perception of Bitcoin as a valuable and rare asset, akin to precious metals like gold.

- Deflationary Nature: Unlike traditional fiat currencies that can be printed indefinitely, Bitcoin’s supply is capped. Halving events contribute to its deflationary nature, potentially leading to increased demand and upward pressure on prices.

- Incentivized Mining Innovation: Halving events reduce the rewards for miners, prompting them to optimize energy consumption and enhance their bitcoin mining operations. This drive for efficiency can lead to advancements in mining technology and sustainability.

- Increased Community Engagement: The anticipation of halving events often sparks discussions and educational initiatives within the crypto community. These conversations help spread awareness about Bitcoin, blockchain technology, and cryptocurrency economics.

Historical Impact on Bitcoin’s Price

Historically, Bitcoin halving events have been associated with significant price increases. For example:

- 2012 Halving: Occurred on November 28, 2012, reducing the reward from 50 to 25 Bitcoins per block. Following this halving, Bitcoin’s price experienced substantial growth.

- 2016 Halving: Took place on July 9, 2016, cutting the reward from 25 to 12.5 Bitcoins per block. Again, the price of Bitcoin rose significantly in the months following the event.

- 2020 Halving: Happened on May 11, 2020, reducing the reward from 12.5 to 6.25 Bitcoins per block. This halving was followed by a remarkable increase in Bitcoin’s price, reaching new all-time highs.

- 2024 Halving: The most recent bitcoin halving took place on April 19, 2024. At the time, the reward for each block of mined bitcoin was cut in half from 6.25 BTC to 3.125 BTC. This event occurs approximately every four years, or more precisely, every 210,000 blocks.

While these trends suggest a positive correlation between halving events and Bitcoin’s price, it’s essential to remember that correlation does not imply causation. Various factors, including market sentiment, adoption trends, and macroeconomic conditions, also play a role in price movements.

Preparing for Bitcoin Halving

For most Bitcoin holders, no direct action is required in preparation for a halving event. However, staying informed about the event’s timing and potential market impacts is beneficial. Here are a few considerations:

- Newcomers: Educate yourself on the basics of the halving process and its significance in the broader crypto market context.

- Long-Term Investors: Consider historical trends associated with halving events, monitor market sentiment, and be cautious of short-term volatility.

Impact on Transaction Fees

Bitcoin halving indirectly affects transaction fees on the network. As block rewards for miners decrease, competition among users to have their transactions included in blocks may increase. This heightened competition can lead to higher transaction fees, especially during periods of high network activity.

Risks Associated with Bitcoin Halving

While Bitcoin halving is generally viewed positively, there are inherent risks, particularly in the short term:

- Market Volatility: Anticipation leading up to a halving can create speculative behavior, potentially resulting in increased volatility.

- Temporary Price Corrections: If market expectations are not met, temporary price corrections may occur.

Past & Future Halving Events

The Bitcoin protocol ensures that halving events will continue until all 21 million Bitcoins have been mined. As of August 2024, four Bitcoin halvings have occurred:

- November 28, 2012: Reward reduced from 50 to 25 Bitcoins per block.

- July 9, 2016: Reward reduced from 25 to 12.5 Bitcoins per block.

- May 11, 2020: Reward reduced from 12.5 to 6.25 Bitcoins per block.

- April 19, 2024: Reward reduced from 6.25 to 3.125 per block.

- March 26, 2028: Is the next scheduled Bitcoin halving. Mark you calendars!

Post-2140: No More New Bitcoins

When the last Bitcoin is mined around the year 2140, bitcoin miners will no longer receive block rewards. Instead, they will rely solely on transaction fees for validating blocks. This transition underscores the importance of a sustainable and efficient network.

Final Thoughts for Bitcoin Holders

Bitcoin holders should approach halving events with a measured and informed perspective. While historical trends indicate potential for price increases, the dynamic nature of the cryptocurrency market requires careful consideration of individual risk tolerance and investment goals.

Helio Lending remains committed to providing valuable insights and expert guidance to help our clients navigate the evolving landscape of cryptocurrency investments with low-rate crypto loans. Understanding Bitcoin halving is crucial for making informed decisions and leveraging the opportunities within the digital asset market.