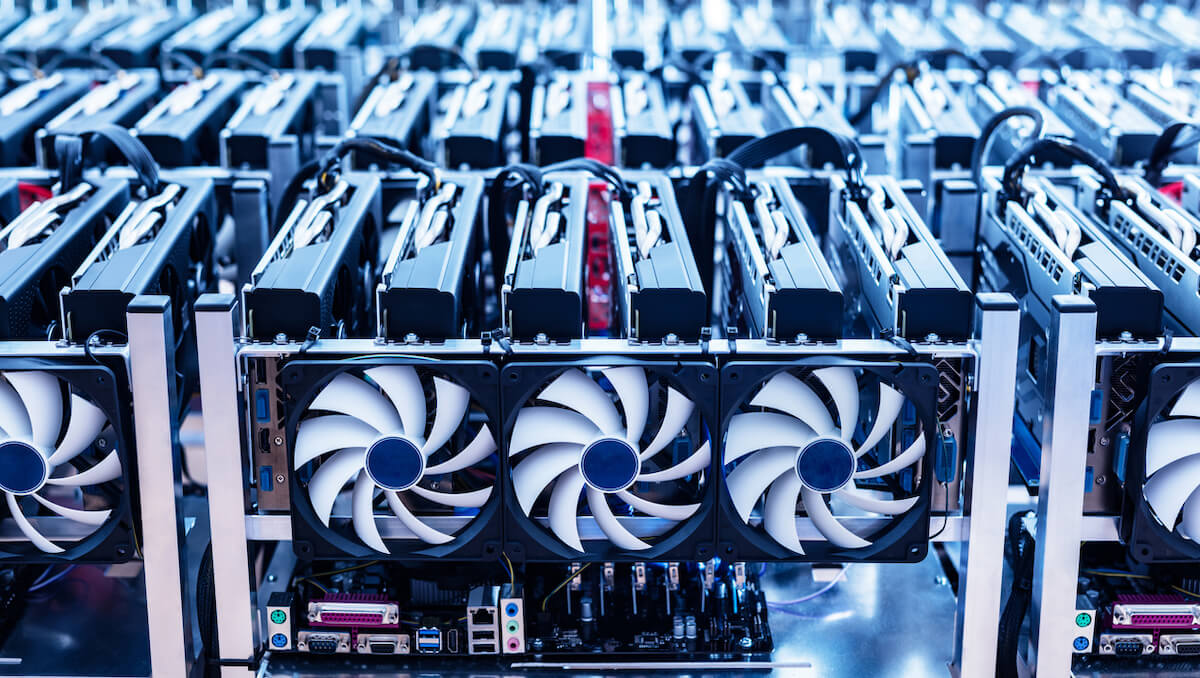

As cryptocurrency investing evolves daily around the world, mining crypto still remains a cornerstone of the digital currency world. Yet, as any seasoned miner knows, the upfront costs and ongoing expenses can be as daunting as the quest for the block reward itself. Enter crypto loans — a financial innovation that’s changing the game for miners everywhere. Below, we’ll dive deeper into the mechanics of crypto loans and how they can turbocharge your mining endeavors, helping you choose the best crypto lending provider in 2024.

Understanding Crypto Loans: A Primer

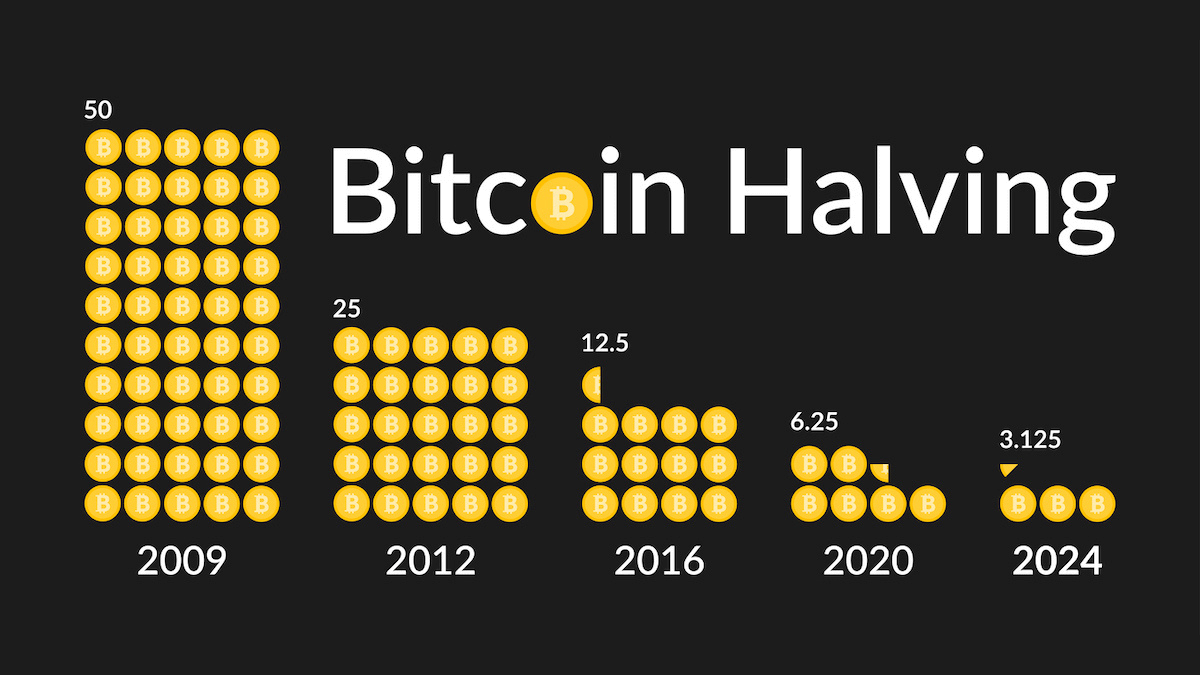

As of 2024, there are around 219 million people who own Bitcoin and about 420 million people who own some form of crypto worldwide. This large pool of crypto holders can leverage their assets for loans, turning digital currency into a liquidity lifeline without having to sell their holdings. Crypto loans use digital assets as collateral, allowing miners to access funds to invest in the latest mining tech or cover operational costs. Here’s how it works: pledge your crypto, receive fiat or stablecoins, and repay under agreed terms to reclaim your collateral, often with added interest.

Crypto Loans: An Ally for Miners’ Growth

Strategic miners are increasingly using crypto loans to their advantage. These financial tools allow them to borrow against their existing crypto assets, providing the capital needed to grow without liquidating their holdings. This strategy is particularly advantageous for those who anticipate an increase in the value of their mined coins. Here’s the process:

- Assessment of Holdings: Miners first assess their crypto holdings to determine how much they can borrow.

- Loan Application: The miner applies for a loan, locking in their crypto assets as collateral. The process is usually quick, with minimal credit checks.

- Receiving Funds: Once approved, the miner receives the funds in stablecoin or their chosen currency, which they can then reinvest into their mining operations.

- Repayment Flexibility: Miners benefit from flexible repayment terms, allowing them to repay the loan when it’s most advantageous, such as when the value of their mined cryptocurrency has appreciated.

Navigating Risks: Smart Borrowing in Crypto Mining

While crypto loans offer a unique opportunity to leverage digital assets, the inherent volatility of cryptocurrencies introduces several risks. Understanding and navigating these risks is crucial, especially in the context of crypto mining where the margins for profit can be slim and the investment in hardware substantial.

Market Volatility: The value of cryptocurrency can fluctuate wildly. If the value of the collateral decreases significantly, the borrower may need to provide additional collateral or risk liquidation.

Liquidation: If the market value of the collateral falls below a certain threshold, the crypto lending platform may liquidate the assets to recover the loan value, often at a less-than-ideal market rate.

Interest Rate Fluctuations: Variable interest rates can increase the cost of borrowing unexpectedly. Fixed-rate loans offer predictability but might come at a higher initial rate.

Regulatory Changes: The crypto industry is subject to evolving regulations that could affect the viability of crypto loans and mining operations.

Platform Risks: The security and stability of the lending platform are critical. There’s always a risk of platform failure, hacks, or fraud.

The Best Crypto Loan Strategies for Miners

To borrow smartly in the volatile world of crypto mining, consider the following strategies:

Conservative Borrowing: Only borrow what you need and can afford to repay, even in a less favorable market.

Diversification: Don’t rely solely on crypto loans for funding. A diversified portfolio of investments and funding sources can mitigate risk.

Risk Assessment: Regularly assess the health of your investments against market conditions. Be prepared to adjust your strategies as the market changes.

Insurance: Some platforms offer insurance products to protect against the risk of collateral liquidation. This can be a wise investment if the terms are favorable.

Emergency Planning: Have a plan in place for margin calls, including a reserve of assets or fiat that can be quickly liquidated if necessary.

Platform Due Diligence: Research the lending platform’s security measures, reputation, and track record. Opt for platforms with a strong security protocol and positive user feedback.

Regulatory Compliance: Stay informed about regulatory changes and ensure that your mining and borrowing activities remain compliant to avoid legal issues.

Frequently Asked Questions about Crypto Loans

What is a crypto loan?

A crypto loan is a financial product that allows you to borrow against your cryptocurrency holdings as collateral, providing liquidity without requiring you to sell your assets.

Can I use a crypto loan for purposes other than mining?

Absolutely. While this article focuses on mining, you can use a crypto loan for any legitimate purpose, from covering unexpected expenses to diversifying your investment portfolio.

What are the risks associated with crypto loans?

The primary risks include the volatility of cryptocurrency affecting your collateral value and the potential for liquidation if the market moves against you.

The Bottom Line on Crypto Loans for Miners

Crypto-backed loans represent a paradigm shift in how miners can sustain and grow their operations. By understanding and utilizing these financial tools, miners can safeguard their assets and amplify their mining potential. With the right strategies, they can ensure their digital treasure hunts are as fruitful as they are strategic. However, these opportunities come with risks that must be carefully managed. By employing smart borrowing strategies and maintaining a vigilant eye on both the market and the chosen lending platform, miners can mitigate these risks and capitalize on the financial opportunities that crypto loans offer in 2024.

If you’re looking to secure a crypto loan, please consider Helio Lending today.