Cryptocurrencies have totally revolutionized the financial world, reshaping traditional asset management and investment strategies. What started as a digital experiment has blossomed into a multi-trillion-dollar market, captivating individual investors, institutional players, and corporate entities alike. This explosive growth has highlighted the necessity for sophisticated financial management within the crypto industry, especially concerning treasury management.

Below we’ll explore the evolution of cryptocurrency mining, the emergence of crypto treasuries, and the pivotal role CFOs and financial professionals play in this dynamic sector.

Evolution of Cryptocurrency Mining

Historical Perspective

The journey of cryptocurrency mining began with Bitcoin‘s launch in 2009. Initially attracting tech enthusiasts and early adopters, mining provided a unique opportunity to acquire cryptocurrencies directly from the blockchain. These early miners were the pioneers in a nascent space that would eventually evolve into a financial powerhouse.

Changing Dynamics

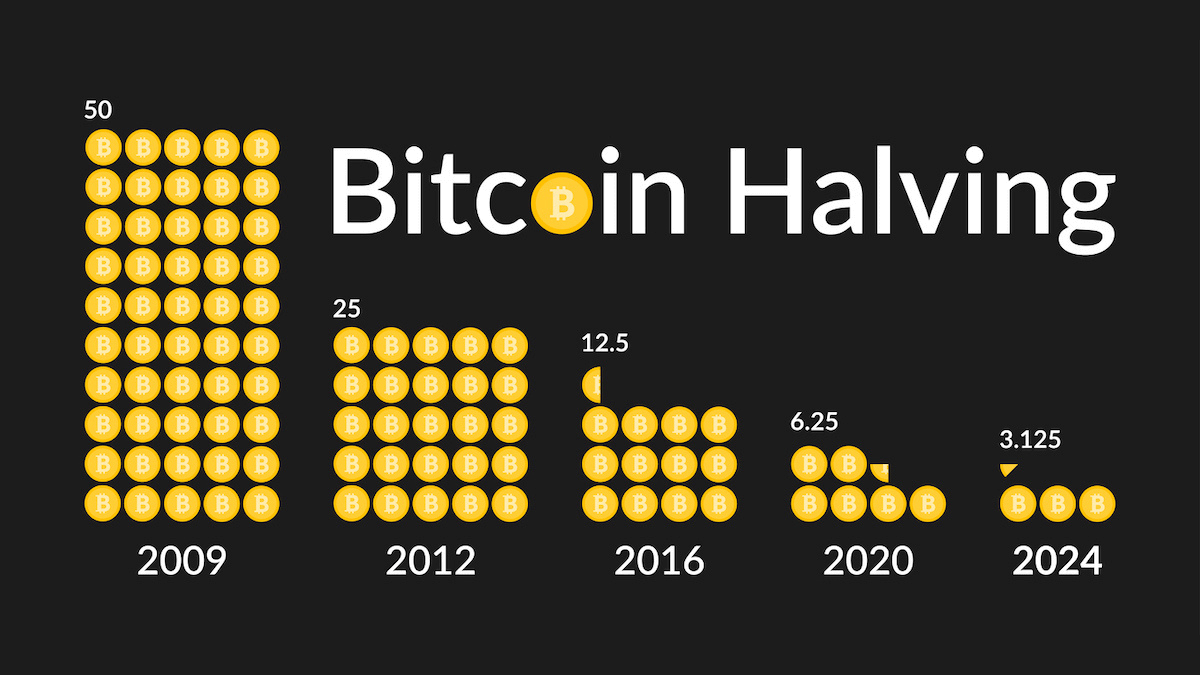

Over time, the profitability of cryptocurrency mining has undergone significant changes. Early miners enjoyed substantial rewards, often seen as a quick path to wealth. However, the mechanism of “halving events,” which periodically reduces mining rewards, has forced miners to adapt to an ever-changing landscape.

Challenges Faced by Miners

While mining can be lucrative, it comes with considerable challenges. Increased competition, rising energy costs, and the need to keep pace with evolving technology have made it imperative for miners to adopt effective treasury management strategies. Miners validate transactions, secure networks, and mint new digital coins, investing heavily in infrastructure, electricity, and hardware. Their core challenge is balancing the retention of crypto assets with the operational needs of their business.

Miners, much like CFOs, face a unique set of challenges:

Crypto as the Lifeblood: Miners are passionate about cryptocurrencies, viewing them as the future of finance. This drives their desire to hold onto their assets long-term.

Operational Needs: Miners have immediate expenses, such as electricity bills and employee salaries, often covered by crypto rewards that do not always align with their expenditure timelines.

Liquidity Dilemma: Miners need liquidity to operate and expand but must carefully time asset sales to avoid significant losses.

These challenges underscore the importance of treasury management, where strategic planning and decision-making ensure sustainable growth. Cryptocurrency loans are emerging as a key strategy, providing miners with liquidity without the need to liquidate assets.

Crypto Loans: Empowering Miners

One transformative solution for miners is cryptocurrency loans. These loans allow miners to access cash without selling their crypto holdings. By leveraging their crypto assets as collateral, miners can obtain the necessary operational capital while avoiding the complexities of asset liquidation. This approach mitigates risks associated with the volatile crypto market, enabling miners to maintain strategic asset retention and participate in potential asset appreciation over time.

CFOs and Treasury Management: Bridging the Gap

The challenges and strategies faced by miners are closely aligned with those of CFOs and financial professionals in crypto companies. Both aim to maximize returns and manage treasury effectively.

Smoothing Operational Funding

Both miners and CFOs need stable operational funding. Extending their cash runway allows for proactive, strategic, and efficient management of crypto assets. Effective treasury management strategies can provide several months’ worth of cash reserves, reducing the need for immediate asset sales.

Risk Management

Risk management is crucial for both miners and CFOs. Diversification of assets and the use of options trading to hedge positions are vital strategies to manage market volatility. These techniques ensure the retention and protection of crypto assets during market fluctuations.

Regulatory Considerations

Navigating the evolving regulatory landscape is a shared challenge. A resilient operational capital structure is essential for adapting to new regulations while maintaining stable operations. Compliance with regulatory changes requires careful planning and strategy.

Rise of Crypto Treasuries

Understanding Crypto Treasuries

In the crypto world, a treasury isn’t a room filled with cash and gold but a digital wallet stocked with various cryptocurrencies. Companies are increasingly embracing crypto treasuries to manage assets, harnessing the potential of crypto’s long-term value and diversification benefits.

Benefits of Holding Cryptocurrencies

Holding cryptocurrencies in treasuries offers numerous advantages, including high liquidity for quick transactions, a hedge against economic instability, and protection against inflation. These benefits are driving more companies to incorporate crypto treasuries into their financial strategies.

Effective Treasury Management Strategies

Effective treasury management in the crypto sector involves several strategies:

Risk Management: Mitigating the impact of market volatility through diversification and hedging.

Asset Diversification: Spreading risk across various crypto assets to balance the portfolio.

Regulatory Compliance: Adhering to evolving regulations to ensure stable operations.

Case Studies: Treasury Management in Action

MicroStrategy

MicroStrategy, a business intelligence software company, allocated a significant portion of its treasury to Bitcoin. This strategic move demonstrated their belief in Bitcoin’s long-term value and highlighted the benefits of diversification within a crypto treasury.

Tesla

Tesla invested $1.5 billion in Bitcoin, recognizing it as a store of value and liquidity. This move proved highly profitable, exemplifying the advantages of incorporating digital assets into a corporate treasury.

Regulatory Challenges and Compliance: Navigating Uncharted Waters

As the crypto industry evolves, so does the regulatory landscape. Companies must navigate these changes, balancing the benefits of digital assets with compliance considerations.

Regulatory Compliance

Crypto companies often operate in a regulatory gray area. CFOs and financial professionals need to stay informed about legal and tax implications, ensuring clear policies and documentation for adherence to laws.

Changing Regulations

Regulations affecting the crypto sector are continually evolving. Companies must remain adaptable, ready to adjust strategies and operations in response to new legal requirements.

CFOs in the Crypto Space: Navigating Complex Territory

The role of CFOs in the crypto landscape has expanded significantly. They must manage financial operations in a volatile market, leveraging traditional financial expertise while adapting to the unique aspects of cryptocurrencies.

Leveraging Knowledge

CFOs bring traditional financial expertise into the crypto space, thinking strategically about managing crypto assets, understanding their volatility, and considering tax implications. Effective treasury management strategies include risk mitigation, asset diversification, and regulatory compliance.

Cryptocurrency Loans

Cryptocurrency loans are a specific strategy employed by CFOs. These loans provide liquidity without selling crypto assets, enabling companies to address short-term operational needs while retaining their holdings.

The Bottom Line on Treasury Management for Crypto

The rapid growth of the crypto industry and the rise of crypto treasuries present unique challenges and immense opportunities. Effective treasury management strategies, coupled with compliance diligence, provide companies with a competitive edge in the dynamic world of digital assets. As the industry continues to mature and regulatory frameworks evolve, CFOs and financial professionals will play a crucial role in helping companies thrive in this exciting and unpredictable landscape.